There is a common belief which states that inflation stands for a general rise in prices. However, this conviction couldn't be further from the truth. Everybody seems to be talking about inflation these days, but very few people understand what it actually means. Allow me to clarify the Austrian definition of inflation, its divergence from the classical view, and why it holds significance for each and every one of us.

Average consumers gauge inflation through personal experiences, such as noticing a more expensive shopping cart or observing rising numbers on price tags. It is understandable why people hold this perspective, but it is ultimately an erroneous view. First things first, is inflation merely a number? Well, as I will elaborate on, it is not. Inflation is not merely a numerical figure; it encompasses much more. Consumers tend to care about prices when they directly affect them, but how do we accurately determine the extent to which prices have actually increased?

There are several ways to “measure” inflation but the most common way to quantify this increase in price is a statistic called the Consumer Price Index (CPI). What you need to know about this is that this statistic is made up by the government, and it is not an economic variable. The CPI represents the average prices of a hypothetical basket of goods[1] (selected by the government). This basically means that the CPI indicates a biased estimation, as a limited amount of goods are included. Imagine that every Friday you visit a fruit store and consistently purchase bananas, pears, and oranges. Over time, if you notice the prices of these items increasing, you might start measuring the extent of the price rise. This can be done by calculating the price changes for oranges, bananas, and pears. Additionally, if you determine the average cost of your entire fruit basket, including oranges, apples, and pears, you can establish your personal fruit consumption index, let's say it's 4%. However, this is different from how the government applies the CPI, as in this case, the index of the chosen goods is 4%, the government will be claiming that general inflation is 4%. This is indeed wrong, as it only works for people who consume these fixed goods. It's important to note that this index only applies to individuals who exclusively consume pears, oranges, and bananas. For those who buy other fruits like pineapples, kiwis, or grapes, the price index will be different. Partial consumers, who choose to buy oranges and other unmeasured products, will experience a lower inflation rate than 4% (assuming the prices of other products remain constant).

The government selects a basket of goods that are not possessed by any particular individual. As you may comprehend, it’s quite unique to possess iron, charcoal, medical care, and transportation services. Far more complex than choosing different fruits every Friday. The purpose of this diverse selection is to analyze what an average person spends on housing, energy, food, and other necessary items. Overall, the CPI calculation implies that the government decides the rate of inflation by including specific factors in the calculation. The output proposed by the statistic is not necessarily accurate, as you may not be consuming the selected fruits.

Using CPI as an indicator hence brings certain problems. By having a fixed amount of goods, the capacity that citizens have to notice the rising prices is limited. In real terms, as no one holds those goods together as theirs, consumers will not experience the current CPI claim. The flaw lies in the fact that this measure is focusing on the wrong aspect. This is where Austrian Economics comes into play, correcting an error that stems from the core of the problem, suggesting the true version of inflation.

Inflation is a general increase in prices and a fall in the purchasing value of money – Definition from Oxford Languages

First of all, Inflation by its current definition is not a problem. The concept of generally rising prices is completely fine and innocuous. Austrians would not be concerned about inflation if it simply involved an increase in all prices and people's wages. If all prices were to rise simultaneously and everyone received their money at the same time, there would be no issue with it. In relative terms, your food basket would be 50 euros more expensive, but your salary would also increase by 50 euros. Therefore, there would be no real problem as your purchasing power, or the value of your holdings, would remain unchanged (you could still buy the same goods as before). The current definition of inflation does not explain what is wrong with it, as prices rising is not necessarily a problem.

If you were to ask random people on the streets about the causes of inflation, most of them would likely mention various factors or indicators associated with this economic phenomenon. However, this widespread belief is actually a misconception. Inflation is not a result of multiple causes working together.

Austrian's view holds that inflation occurs solely when the government increases the money supply, a monocausal effect. Printing more money and unnaturally injecting it into markets, nothing else. In simple terms, when money is given or injected into the economy, it leads to increased consumption of goods and services, resulting in higher prices. However, this approach poses certain problems. The act of giving money privileges certain individuals or entities, allowing them to benefit from the price increases before they affect the overall economy. Imagine receiving millions as a subsidy, enabling you to purchase goods at pre-inflation prices while others have to contend with rising prices. This advantage is unnatural and controversial, as it raises questions about the allocation of money and why certain individuals receive it while others compete under the same rules.

To further illustrate this point, Friedrich von Hayek, one of the founders of Austrian Economics, used a metaphor involving pouring honey onto a cold marble table. If the honey is poured rapidly, it forms a small mound that gradually flattens out as the pouring ceases, eventually spreading across the entire table. In the present, when the money is received by an individual, the mound is huge and steep, as you haven’t started spending this income. As you haven’t started spending, inflationary pressures are yet not reflected by the good prices, and hence whoever receives the subsidy has an advantage. You can buy goods with an abnormal future income, with past prices. This analogy effectively captures the nature of antinatural money injection by the government, highlighting the uneven distribution of benefits and its impact on the economy.

Overall, having more capital to spend, enables you to afford more than before. Unlike other economic schools of thought, the Austrian perspective disregards factors like supply and demand, wage pressures, or technological advancements as causes of inflation. Inflation is not a multifactual effect, instead, Austrians attribute inflation primarily to government intervention through money creation and deficit spending. The Austrian perspective emphasizes the importance of sound money[2] and the need to limit government intervention to maintain price stability and economic prosperity.

There is a clear time difference in who and how we perceive a difference in prices, which depends on what we consume. If there was an increase in the price of vegan products, how long would it take until you realize this? If the government's CPI says something that we don't see, it's because the goods included in the CPI do not fit our consumption pattern, and it is a matter of time before prices affect us, hence it is only logical that the lag effect benefits certain people sooner. In the short run, an increase in the quantity of money has effects on some prices and not others, and this creates distortions in the market. Prices convey information and it has winners and losers. Hence, depending on what you consume, you will notice inflation in the near future or eventually. Noticing inflation sooner qualifies you as a loser. We already stabilized that inflation is an increase in money supply and that rising prices are a consequence of inflation. But the real effect is not rising prices itself, it's losing purchasing power. As explained, rising prices are not necessarily a problem as long as your wage rises proportionally. But, if the government abnormally injects money into markets, prices rise artificially, while your salary stays fixed, as you signed a contract with your working company which is not going to magically change.

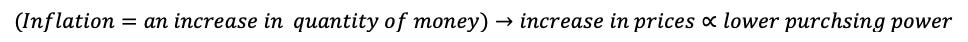

We could say that inflation works like this:

For those who hate math, this expression communicates that inflation is an increase in the amount of money (unnaturally injected by the government) which causes (arrow) a general rise in prices which implies that proportionally (proportionality sign) you are losing purchasing power.

Let’s reflect and consider this question: If inflation is an increase in prices, what is rising prices? If you really want to answer, you would probably be tempted to respond with "inflation"? This creates a circular loop because inflation is not synonymous with rising prices; rather, rising prices are a consequence of inflation. Saying that prices are rising because prices are rising makes no sense. Simplifying, if fire is characterized as burning flames, what term would you use to describe smoke? You won’t describe fire as smoke, because fire produces smoke, and not vice versa. This loop arises because smoke is not equivalent to fire; instead, smoke is an outcome of fire.

Think about it, by claiming that the tendency of all prices and wage rates to rise is so-called “inflation”, we are left with a deplorable confusion that there is no term left to signify the cause of this rise in prices and wages. Hence, there is no longer any word available to signify the phenomenon that has been up until now called inflation. As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are, in fact, only fighting what is the inevitable consequence of this – rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. The government tries to keep prices low while firmly committing to a policy of increasing the quantity of money. They must be agonizing because of that. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation. The current definition of inflation does not target the root cause of the problem.

How could CPI propose a certain result of the rate of inflation if it’s measuring the consequence of the problem rather than the problem itself? Is there room for another indicator that uses government spending as a main target to measure not only actual but future inflationary pressures?

Overall, the current idea that inflation is rising prices is that it doesn't explain what is wrong with it, and it doesn't get us to the root cause. It begs the question: What precisely triggers the price surge? It's become circular, stating that prices are increasing due to prices themselves going up is illogical. The singular factor driving price increases is, unequivocally, the injection of monetary measures by the government. From my perspective, the current academic and worldwide popular definition of inflation is one of the greatest fallacies in human history.

Inflation is the increase/growth in the quantity of money, which leads to a loss of purchasing power. unfairly attributing them as the culprits for inflation and shifting the blame onto scapegoats. Important questions arise here: Who is in charge of increasing the money supply and, consequently, who is in charge of the fallacy? And why are they interested in maintaining it? The responsibilities lie within central banks and the government, as they are the only ones responsible for printing money and legislating it to the markets. The question of why institutions would be interested in keeping the fallacy alive is quite simple. Who bears the responsibility for the plight of hundreds of families, particularly those who are less privileged and bear the brunt of diminished purchasing power? For the government, in the case of these families struggling to afford essential goods and make ends meet, it is convenient to place the blame on something as mundane as the price of chicken, employing magical explanations. Saying that the blame for a decrease in purchasing power is the increase in the price of Chicken, or any other good, sounds like a magical spell (The chicken, which has magically increased in price, a problem that we (the government) have nothing to do with, is responsible for the fact that you can't afford as much as before). If the government were to acknowledge its complete culpability in this matter, how would it fare in future elections? How could infrastructure projects be funded without resorting to debt issuance and money creation?

Finally, how does this knowledge about inflation help you? Well, in a situation where there are a lot of doubters out there ensuring that they are not perceiving the rise in prices (as a consequence of government spending), or even after reading this article someone says, “We were told that money printing would cause inflation, but it hasn't happened yet." By applying the proper definition of inflation, you should know by now that inflation is already there, and it is a matter of time before that effect comes through the system and affect certain prices that are going to affect you. There are lag effects as a consequence of unnaturally injecting money into the market, and the CPI does not reflect the percentage of inflation that is currently affecting you. Overall, the Austrian perspective helps you prepare for Future Events.

[1] A basket of goods refers to a number of products that are selected for a certain reason.

[2] Sound money means having a currency that is stable in value, limited in supply, and not subject to government manipulation.